Why You Should Have An Emergency Fund in 2020 Emergency fund, Fund

Your business emergency fund could be used for that as well. The final benefit is that your emergency fund can earn you interest as it sits in an interest-bearing account. Three tips to remember when building your emergency fund 1. Plan for the worst . You cannot predict the unpredictable, but you can save and plan as if something bad might happen.

5 Tips for Rebuilding Your Emergency Fund After Tough Times NFCC

Adams estimates that most older folks who have emergency funds keep about $5,000 in them. Some of her elderly clients keep about $10,000 in their emergency funds, and a few keep up to $100,000. It's probably better to have too big an emergency fund than too small, says Hamrick. "I never met a person who told me they saved too much money.

Why Do You Need an Emergency Fund, and How Much Do You Keep in Your

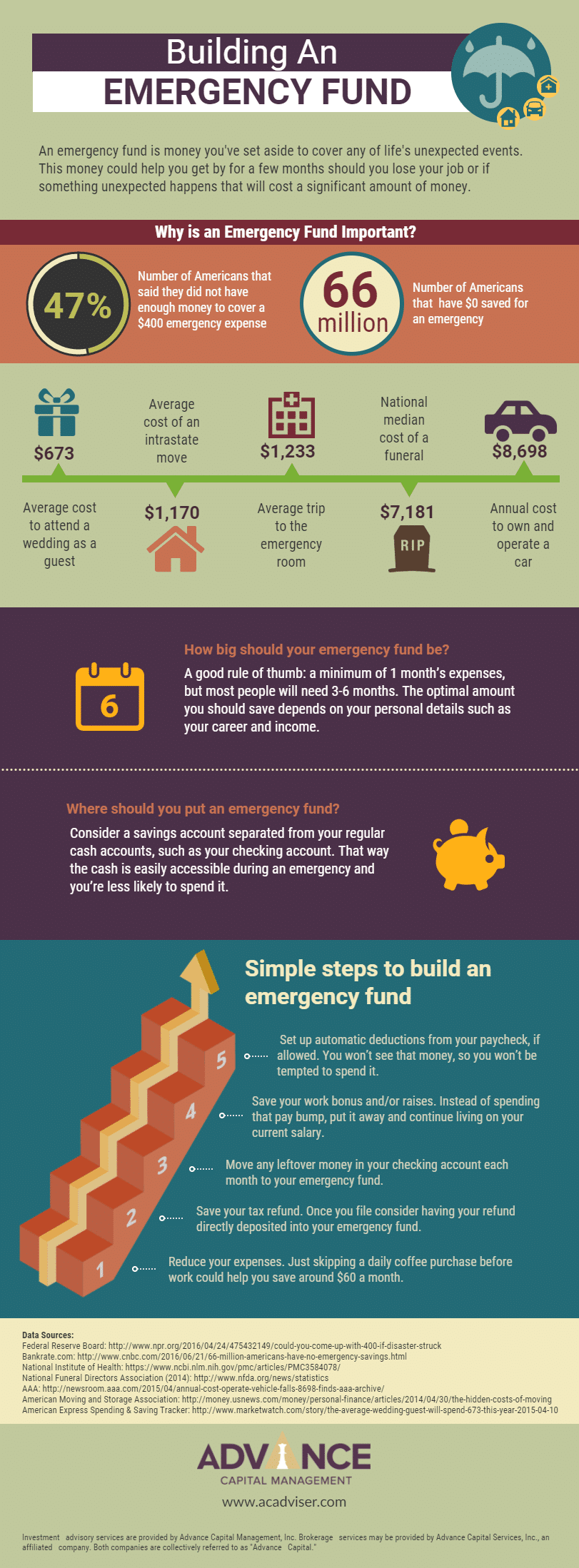

Here are some of the best options for where to keep an emergency fund. 1. High-Yield Savings Account. Opening a high-yield savings account to start an emergency fund makes a lot of sense. Almost.

Understanding The Need For An Emergency Fund

Hey there! In this article, we will talk about why having an emergency fund is crucial for your financial stability. Life's full of surprises; sometimes, things can get really tough on the money.

Why is it important to have an emergency fund account? Mint

An emergency fund (aka a rainy day fund) is cash that's set aside to cover the cost of unexpected, and often expensive, events. These savings are meant to be used for real, urgent needs—like to pay rent when your income dries up or to foot an unplanned medical bill.

Why it’s vital to have an emergency fund in place Saga

Why having an emergency fund is important. Emergencies are predictably unpredictable, often striking when we're the least prepared for them personally and financially. In fact, more than 35% of Americans would not be able to pay for an unexpected $400 expense, according to the Federal Reserve. 1.

How Much Money Should My Business Have in an Emergency Fund? (2023)

An emergency fund needs to be kept separate enough from your day-to-day expenses so that you are not tempted to dip into it to cover minor expenses you failed to budget for. At the same time, the money needs to be quickly accessible for when you do need it. It is also important that your emergency money remain safe, both from the risk of.

5 Huge Reasons You Need an Emergency Fund Money Nation

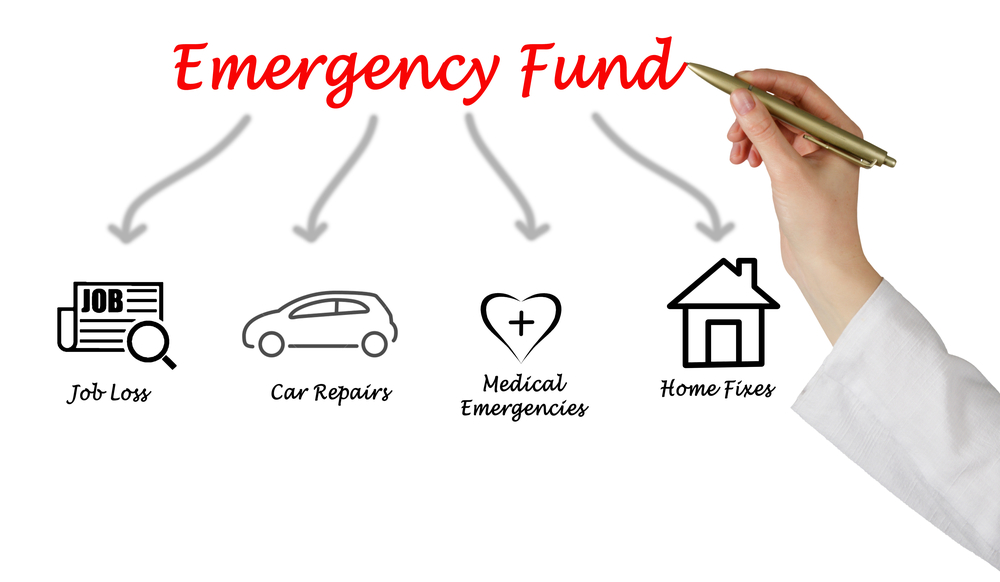

An emergency fund is a bank account with money set aside for big, unexpected expenses like job loss, medical bills and other emergencies.. It can be especially important to have an emergency.

What to Do Once You Have an Emergency Fund Young Adult Money

An emergency fund is a cash reserve that's specifically set aside for unplanned expenses or financial emergencies. Some common examples include car repairs, home repairs, medical bills, or a loss of income. In general, emergency savings can be used for large or small unplanned bills or payments that are not part of your routine monthly.

Why an Emergency Savings Fund is so Important Advantage CCS

Here's why: Your emergency fund covers you in the event of an unexpected financial blow and can help prevent you from going into debt. It also provides peace of mind if you lose your job, become too ill to work, or have to cover a major car or home repair. There are many reasons why you should work on padding your emergency fund.

Why You NEED an Emergency Fund! YouTube

1. Peace Of Mind. One of the most obvious reasons why an emergency fund is important is that it provides you with an incredible amount of peace of mind. In other words, when you have a nice big pile of cash just sitting there waiting to jump into action and save you from a financial emergency, you don't have to worry about unexpected expenses.

Why You Need an Emergency Fund Good Life. Better.

To prepare for income shocks, many experts suggest keeping enough money in your emergency fund to cover 3 to 6 months' worth of living expenses. So if you spend $5,000 per month, your first emergency fund savings milestone should be $2,500 to cover spending shocks. For your longer-term goal of an emergency fund that will cover income shocks.

A Quick Guide to Building an Emergency Fund INFOGRAPHIC

Having an emergency fund means you can weather a financial storm without borrowing money, whether that's taking out a large loan or putting a big purchase on a credit card. Both of those tend to.

Is it Important to Have an Emergency Fund? Thinking Big Financial

An emergency fund is a savings account containing money to be used only in the event of an emergency, such as losing your job, being faced with a sudden medical condition, or having to make an.

Need and Benefits of Emergency Fund SBS Fin

Emergency fund definition. An emergency fund is money you set aside for unexpected costs. These savings are meant for emergency expenses that are separate from your typical monthly and weekly expenses. Additionally, these emergency savings can be used to help you if you lose income due to job loss or sickness.

Emergency Funds vs Sinking Funds (Master A Budget Series) My Worthy

Crunching the Numbers. With that perspective in mind, let's consider how to save for an emergency fund. Approach this effort the same way you would approach any other financial goal. Put.